Modern organizations rely heavily on data-driven insights to plan for the future. Anticipating demand, estimating revenue, managing inventory, and predicting market behavior are all critical activities. These tasks are made possible through structured analytical approaches that transform historical data into meaningful predictions. This is where forecasting becomes an essential discipline.

Forecasting is not limited to business alone. It plays a vital role in economics, healthcare, finance, supply chain management, weather prediction, and public policy. As data availability and computational power increase, the role of forecasting continues to expand across industries.

What Are Forecasting Models

Forecasting models are mathematical, statistical, or computational representations used to predict future values based on historical data and underlying patterns. These models analyze trends, seasonality, cycles, and relationships within data to generate informed estimates about what may happen next.

Rather than relying on intuition alone, organizations use forecasting models to reduce uncertainty and support strategic planning. The effectiveness of a forecast depends on data quality, model choice, and correct interpretation of results.

Importance of Forecasting Models in Decision Making

Forecasting models provide a structured way to look ahead. Their importance lies in their ability to support proactive decision-making rather than reactive responses.

Key benefits include:

- Improved planning and budgeting

- Better resource allocation

- Risk reduction and contingency preparation

- Enhanced operational efficiency

- Competitive advantage through informed strategies

Accurate forecasts allow organizations to anticipate changes and adapt more effectively in dynamic environments.

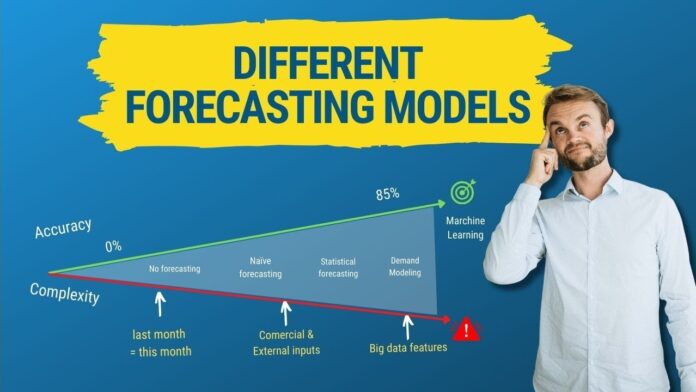

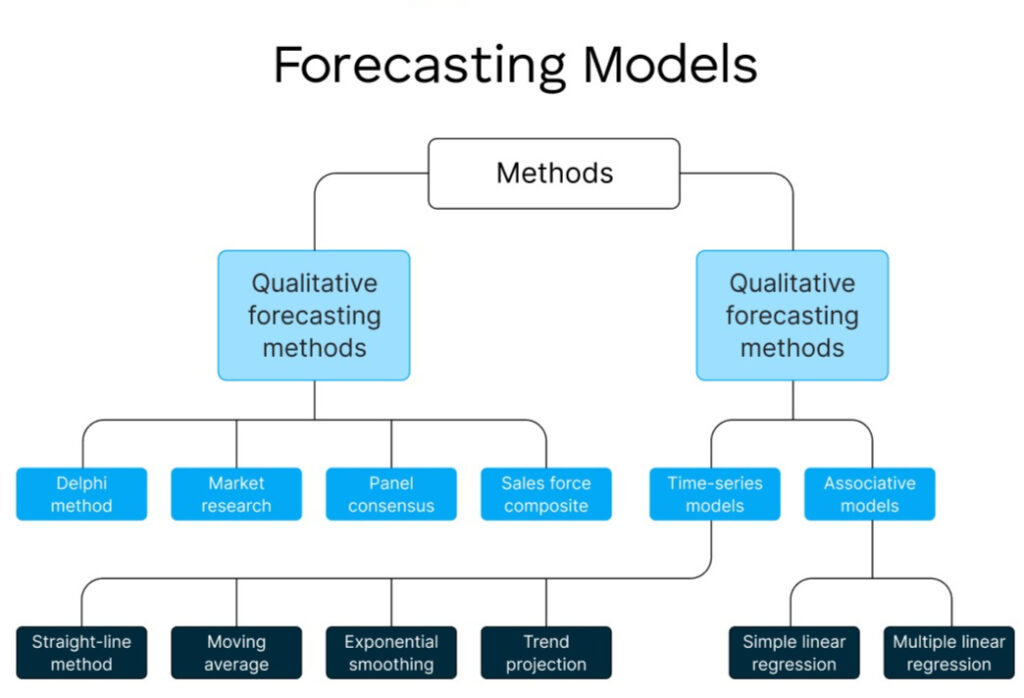

Types of Forecasting Models

Forecasting models can be broadly categorized based on methodology and data usage. Understanding these categories helps in selecting the right approach for a given problem.

The two primary classifications are:

- Qualitative forecasting models

- Quantitative forecasting models

Each category serves different purposes depending on data availability and forecasting objectives.

Qualitative Forecasting Models

Qualitative forecasting models rely on expert judgment, experience, and subjective assessment rather than numerical data. These models are useful when historical data is limited or unavailable.

Common qualitative approaches include:

- Delphi method

- Market research and surveys

- Expert opinion panels

- Scenario analysis

Such models are frequently used in new product launches, emerging markets, and long-term strategic planning.

Quantitative Forecasting Models

Quantitative forecasting models use historical numerical data to identify patterns and relationships. These models are data-driven and rely on mathematical techniques.

They are particularly effective when:

- Reliable historical data is available

- Patterns are stable over time

- Forecast horizons are short to medium term

Quantitative forecasting models form the foundation of most modern predictive analytics systems.

Time Series Forecasting Models

Time series forecasting models analyze data points collected at regular intervals over time. The primary assumption is that historical patterns will continue into the future.

Key components of time series data include:

- Trend

- Seasonality

- Cyclical patterns

- Irregular variations

Understanding these components is crucial for building effective forecasting models.

Causal Forecasting Models

Causal forecasting models examine the relationship between a target variable and one or more influencing factors. Unlike time series models, these approaches focus on cause-and-effect relationships.

Examples of causal variables include:

- Price changes

- Marketing expenditure

- Economic indicators

- Environmental factors

Regression-based models are commonly used for causal forecasting.

Statistical Foundations Behind Forecasting Models

Most forecasting models are built on statistical principles such as probability distributions, correlation, and hypothesis testing. A strong statistical foundation ensures that forecasts are interpretable and reliable.

Important statistical concepts include:

- Mean and variance

- Autocorrelation

- Stationarity n- Error distribution

These concepts help assess model assumptions and forecast accuracy.

Common Forecasting Models Explained

Several forecasting models are widely used across industries due to their simplicity and effectiveness. Choosing the appropriate model depends on data characteristics and business objectives.

Some commonly applied approaches include:

- Naive forecasting

- Moving average models

- Exponential smoothing

- Linear regression models

Each model has strengths and limitations that must be carefully considered.

Moving Average and Exponential Smoothing Models

Moving average models smooth short-term fluctuations by averaging data points over a specified window. They are easy to implement and interpret.

Exponential smoothing models assign greater weight to recent observations, making them more responsive to changes. Variants include:

- Simple exponential smoothing

- Holt’s linear trend method

- Holt-Winters seasonal method

These models are popular in demand forecasting and inventory management.

ARIMA and Seasonal Forecasting Models

ARIMA models combine autoregressive, differencing, and moving average components. They are powerful for handling stationary time series data.

Seasonal ARIMA extends this framework to account for repeating seasonal patterns. These forecasting models are widely used in finance, economics, and operations planning.

Machine Learning-Based Forecasting Models

Advances in computing have enabled the use of machine learning techniques for forecasting. These models can capture complex, nonlinear relationships in data.

Common machine learning approaches include:

- Decision trees and random forests

- Gradient boosting methods

- Neural networks

- Long short-term memory networks

Machine learning forecasting models are especially useful for large, high-dimensional datasets.

Forecasting Models in Business and Economics

Businesses use forecasting models to predict sales, revenue, cash flow, and market demand. In economics, these models support policy analysis and macroeconomic planning.

Applications include:

- Sales forecasting

- Financial planning

- Demand and supply analysis

- Economic growth prediction

Accurate forecasts support sustainable growth and stability.

Forecasting Models in Data Science and Analytics

In data science, forecasting models are a key component of predictive analytics pipelines. Analysts use them to extract insights from historical data and guide future actions.

Typical workflows involve:

- Data preprocessing

- Feature engineering

- Model training and validation

- Performance evaluation

Forecasting models integrate seamlessly with modern analytics platforms.

Real-World Examples of Forecasting Models

Real-world applications highlight the practical value of forecasting models:

- Retailers predicting product demand

- Airlines forecasting passenger traffic

- Energy companies estimating consumption

- Healthcare systems predicting patient admissions

These examples demonstrate how forecasts influence operational and strategic decisions.

Model Selection and Evaluation Techniques

Selecting the right forecasting model requires careful evaluation. Common performance metrics include:

- Mean absolute error

- Mean squared error

- Root mean squared error

- Mean absolute percentage error

Cross-validation and back-testing help assess model robustness and reliability.

Considerations in Forecasting Models

As organizations mature in their data capabilities, forecasting models move beyond basic prediction and become strategic decision-making tools. Advanced forecasting focuses not only on accuracy but also on reliability, scalability, interpretability, and adaptability to changing environments.

Model Selection Strategy

Choosing the right forecasting model depends heavily on the business context and data characteristics. There is no universal best model.

Key factors influencing model selection include:

- Nature of the data (stationary vs non-stationary)

- Forecast horizon (short-term vs long-term)

- Data frequency (daily, monthly, yearly)

- Availability of historical data

- Requirement for explainability

- Computational constraints

For example, classical time series models perform well for stable, linear patterns, while machine learning-based forecasting models excel in environments with complex nonlinear relationships.

Hybrid Forecasting Models

Hybrid forecasting models combine the strengths of multiple approaches to improve predictive performance. These models are increasingly used in real-world applications.

Common hybrid combinations include:

- ARIMA with neural networks

- Statistical models with gradient boosting

- Decomposition-based forecasting followed by machine learning prediction

A practical example is sales forecasting in retail, where seasonality is handled by time series decomposition and demand volatility is modeled using machine learning.

Hybrid forecasting models reduce bias, improve robustness, and handle complex patterns more effectively than single-model approaches.

Forecasting at Scale

Modern enterprises forecast across thousands of products, locations, and time periods simultaneously. Scaling forecasting models introduces new challenges.

Important scalability considerations:

- Automated feature engineering

- Distributed model training

- Monitoring forecast drift

- Retraining schedules

- Model governance and versioning

Cloud platforms and MLOps pipelines are increasingly used to operationalize forecasting models in production environments.

Interpretability and Trust in Forecasting Models

Forecast accuracy alone is not sufficient in business environments. Decision-makers need to understand why a model makes certain predictions.

Techniques to improve interpretability include:

- Feature importance analysis

- Partial dependence plots

- SHAP values

- Rule-based surrogate models

Interpretable forecasting models help build trust, especially in regulated industries such as finance, healthcare, and supply chain management.

Handling Uncertainty in Forecasting

Every forecast involves uncertainty. Advanced forecasting models explicitly quantify this uncertainty to support better decisions.

Common methods include:

- Prediction intervals

- Probabilistic forecasting

- Bayesian forecasting models

- Scenario-based forecasting

For example, instead of predicting a single sales value, a probabilistic forecasting model provides a range within which the demand is likely to fall.

This approach allows organizations to plan for best-case, worst-case, and most-likely scenarios.

Evaluation Beyond Accuracy Metrics

While metrics such as MAE and RMSE are essential, real-world forecasting requires broader evaluation.

Additional evaluation dimensions:

- Business impact of forecast errors

- Bias analysis

- Stability across time periods

- Performance during anomalies

- Sensitivity to data changes

A slightly less accurate but more stable forecasting model may be preferred in critical business operations.

Ethical and Responsible Forecasting

Forecasting models increasingly influence decisions that affect people and markets. Responsible forecasting practices are therefore essential.

Key ethical considerations:

- Avoiding biased data sources

- Transparent modeling assumptions

- Regular audits of forecasting outcomes

- Responsible use of automation

Organizations must ensure forecasting models align with ethical guidelines and regulatory standards.

Challenges and Limitations of Forecasting Models

Despite their usefulness, forecasting models face limitations. Uncertainty, data quality issues, and structural changes can affect accuracy.

Common challenges include:

- Overfitting

- Changing market conditions

- Limited historical data

- External shocks

Understanding these limitations helps manage expectations and improve forecasting practices.

Best Practices for Building Reliable Forecasting Models

To improve forecast quality, practitioners should follow best practices:

- Use clean and relevant data

- Understand business context

- Validate assumptions regularly

- Combine multiple models when appropriate

Continuous monitoring and refinement are essential for long-term success.

Future Trends in Forecasting Models

The future of forecasting models is shaped by advancements in artificial intelligence, real-time data processing, and automated machine learning.

Emerging trends include:

- Hybrid statistical and machine learning models

- Real-time forecasting systems

- Explainable forecasting techniques

- Increased integration with decision-support systems

These developments promise more accurate and actionable forecasts.

Future Direction of Forecasting Models

The future of forecasting models is shaped by automation, real-time learning, and integration with decision systems.

Emerging trends include:

- Automated forecasting platforms

- Real-time streaming forecasts

- Integration with reinforcement learning

- Generative AI-assisted forecasting

- Self-correcting models using feedback loops

Forecasting models are evolving from passive predictors into active decision-support systems.

Conclusion

Forecasting models play a critical role in transforming historical data into actionable insights. From traditional statistical techniques to advanced machine learning and hybrid approaches, forecasting has become a cornerstone of modern analytics and strategic planning.

Effective forecasting models are not defined solely by accuracy. They must be interpretable, scalable, adaptable, and aligned with business objectives. Real-world success depends on selecting the right model, handling uncertainty responsibly, and continuously evaluating performance as conditions evolve.

As data availability grows and computational capabilities advance, forecasting models will continue to evolve, enabling organizations to anticipate change, reduce risk, and make informed decisions with confidence. Mastery of forecasting models is no longer optional; it is a fundamental capability for data-driven enterprises.

FAQ’s

What is the data-driven forecasting model?

A data-driven forecasting model uses historical data and statistical or machine learning algorithms to predict future trends, patterns, or outcomes with minimal human bias.

What is data-driven decision-making in data analytics?

Data-driven decision-making is the practice of using data analysis, insights, and evidence rather than intuition to guide business strategies, optimize processes, and improve outcomes.

What are the 4 forecasting methods?

The four common forecasting methods are qualitative forecasting, time series analysis, causal (regression) forecasting, and machine learning–based forecasting.

What are the 5 steps of data-driven decision-making?

The four common forecasting methods are qualitative forecasting, time series analysis, causal (regression) forecasting, and machine learning–based forecasting.

What is the 3 way forecast model?

The 3-way forecast model evaluates outcomes using best-case, worst-case, and most-likely scenarios, helping businesses plan under uncertainty and manage risk effectively.