Financial markets generate enormous amounts of data every second. Prices move, volumes change, and investor sentiment shifts constantly. To make sense of this complexity, market indexes were created.

Rather than analyzing thousands of stocks individually, indexes offer a snapshot of market performance. Among all market benchmarks, one index has stood the test of time and remains deeply embedded in global financial discussions.

That benchmark is the Dow Jones Index.

Before exploring how it works, it is important to understand why it still matters in modern finance despite the rise of newer and broader indexes.

What Is the Dow Jones Index

The Dow Jones Index, formally known as the Dow Jones Industrial Average (DJIA), is one of the oldest and most widely followed stock market indexes in the world.

It represents the performance of thirty large, publicly traded companies listed on U.S. stock exchanges.

These companies are considered leaders in their industries and are often referred to as blue-chip stocks.

Key Characteristics

- Represents major U.S. corporations

- Focuses on industrial, financial, and technology leaders

- Serves as a benchmark for overall market sentiment

History and Evolution of the Dow Jones Index

The Dow Jones Index was introduced in the late nineteenth century by Charles Dow and Edward Jones. Initially, it consisted of a small group of industrial companies designed to reflect the growing U.S. economy.

Over time, the index evolved alongside economic changes:

- Early industrial focus

- Expansion into consumer goods and finance

- Inclusion of technology-driven companies

Despite economic transformations, the Dow Jones Index has remained a reference point for market health.

Companies Included in the Dow Jones Index

The index includes companies selected by editors of a financial publication based on reputation, industry leadership, and sustained growth.

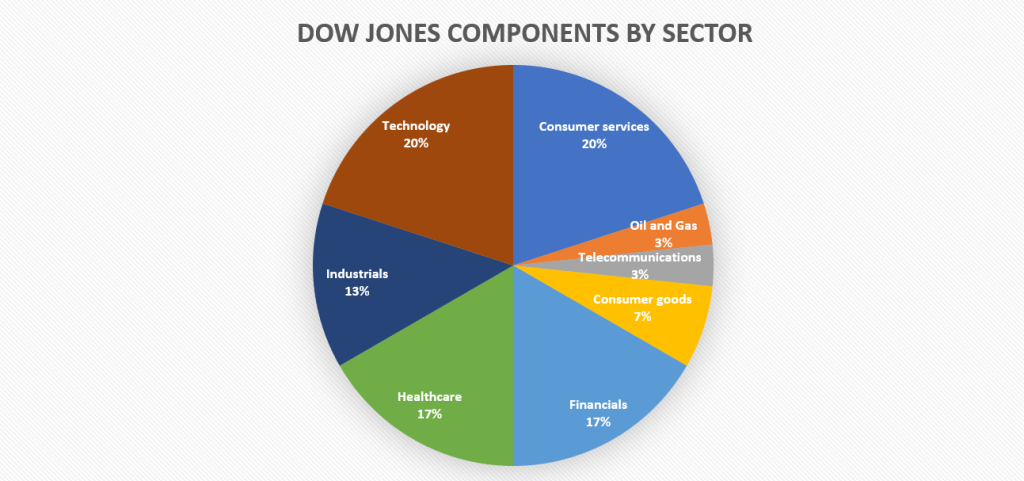

Examples of Company Sectors

- Technology

- Healthcare

- Financial services

- Consumer goods

- Manufacturing

The composition changes occasionally to reflect shifts in the economy.

How the Dow Jones Index Is Calculated

Unlike most modern indexes, the Dow Jones Index uses a price-weighted methodology.

What This Means

- Companies with higher stock prices have greater influence

- Market capitalization is not the primary factor

- Stock splits require divisor adjustments

This calculation method makes the index unique and historically consistent.

Why the Dow Jones Index Is Price-Weighted

When the index was created, computational limitations made price weighting the most practical option.

Although this approach has limitations today, it provides continuity and allows historical comparisons over more than a century.

Dow Jones Index vs Other Major Market Indexes

Comparison Overview

- Dow Jones Index: Price-weighted, thirty stocks

- S&P Index: Market-cap weighted, broader coverage

- Nasdaq Index: Technology-heavy composition

Each index serves a different analytical purpose.

Real-World Examples of Dow Jones Index Movements

Example: Economic Growth Periods

During periods of strong economic growth, industrial and consumer stocks often rise, pushing the index upward.

Example: Financial Crises

Market downturns, interest rate hikes, or geopolitical instability can cause rapid declines.

These movements help investors assess confidence levels.

How Investors Use the Dow Jones Index

Investors rely on the index in multiple ways:

- Market trend identification

- Portfolio performance comparison

- Risk assessment

- Sentiment analysis

It often acts as a reference point rather than a direct investment vehicle.

Dow Jones Index and Economic Indicators

The index reacts strongly to:

- Employment reports

- Inflation data

- Central bank decisions

- Corporate earnings

Because of this, it is often used alongside macroeconomic indicators.

Impact of Global Events on the Dow Jones Index

Major global events influence the index:

- Financial crises

- Pandemics

- Trade policy changes

- Technological breakthroughs

These events highlight the interconnected nature of global markets.

Limitations and Criticism of the Dow Jones Index

Despite its popularity, the index faces criticism:

- Limited number of companies

- Price-weighted bias

- Underrepresentation of certain sectors

These limitations mean it should not be used in isolation.

Dow Jones Index in Long-Term Investing

Long-term investors view the index as:

- A historical performance benchmark

- A signal of economic resilience

- A confidence indicator

It provides context rather than a complete picture.

Dow Jones Index and Corporate Earnings Influence

Corporate earnings play a critical role in shaping movements of the Dow Jones Index.

How Earnings Affect the Index

- Strong earnings reports often push component stock prices higher

- Missed earnings expectations can drag the index downward

- Forward guidance influences future index sentiment

Because the index is price-weighted, earnings surprises from high-priced stocks tend to have a larger impact than those from lower-priced ones.

Dow Jones Index and Interest Rate Sensitivity

Interest rates directly influence equity valuations.

Relationship With Interest Rates

- Rising interest rates increase borrowing costs

- Higher rates can reduce corporate profits

- Lower rates often encourage equity investments

Central bank policy announcements frequently cause immediate reactions in the index, reflecting investor reassessment of future growth.

Dow Jones Index During Market Volatility

Periods of volatility highlight the index’s role as a market barometer.

Volatility Triggers

- Unexpected economic data

- Geopolitical tensions

- Financial system stress

During such periods, the index often experiences sharp intraday swings, providing insight into market fear or optimism.

Dow Jones Index and Dividend-Paying Companies

Many Dow Jones Index components are known for consistent dividend payments.

Importance of Dividends

- Provide income stability

- Attract long-term investors

- Reflect financial health

Dividend-paying stocks contribute to the index’s reputation as a benchmark for established, financially stable companies.

Dow Jones Index and Technological Transformation

Although historically industrial-focused, the index has adapted to technological change.

Modern Shifts

- Inclusion of technology-driven firms

- Digital transformation across traditional industries

- Increased exposure to innovation-based revenue

This evolution helps maintain relevance in a changing economic landscape.

Dow Jones Index in Passive Investing Strategies

While the index itself is not directly investable, it influences passive investment products.

Passive Strategy Uses

- Benchmark for index-linked funds

- Reference for performance evaluation

- Indicator for market exposure decisions

Investors often use it alongside broader indexes to diversify exposure.

Dow Jones Index and Media Interpretation Bias

Media headlines often simplify index movements.

Why Context Matters

- Single-day movements may not reflect long-term trends

- Percentage changes are more meaningful than point changes

- Broader economic context is essential

Understanding this helps investors avoid emotionally driven decisions.

Dow Jones Index in Portfolio Diversification Decisions

Portfolio managers analyze the index to determine diversification needs.

Strategic Uses

- Identifying sector overexposure

- Adjusting asset allocation

- Evaluating correlation with other assets

The index serves as a reference point rather than a standalone portfolio.

Dow Jones Index and Behavioral Finance

Investor behavior strongly influences short-term index movements.

Behavioral Factors

- Herd mentality

- Fear-driven selling

- Overconfidence during rallies

Behavioral finance studies often use index data to analyze these patterns.

Dow Jones Index in Historical Crisis Analysis

Major financial crises provide insights into index behavior.

Observed Patterns

- Sharp declines during systemic shocks

- Gradual recovery phases

- Long-term upward resilience

These patterns are used in stress testing and financial modeling.

Dow Jones Index and Algorithmic Trading

Modern trading systems incorporate index data.

Algorithmic Applications

- Market trend detection

- Volatility-based strategies

- Automated risk controls

Index movements often trigger algorithmic responses across global markets.

Dow Jones Index and Economic Cycle Indicators

The index behaves differently across economic phases.

Economic Cycle Stages

- Expansion

- Peak

- Contraction

- Recovery

Analysts study index trends to estimate the current economic phase.

Dow Jones Index as a Learning Tool for Beginners

For beginners in finance, the index serves as an accessible entry point.

Educational Value

- Simple composition

- Clear price impact

- Long historical record

It introduces foundational concepts such as market trends, benchmarks, and risk.

Dow Jones Index Data and Historical Backtesting

Historical index data is widely used for backtesting strategies.

Backtesting Uses

- Strategy evaluation

- Risk modeling

- Performance comparison

Backtesting helps identify strengths and weaknesses in investment approaches.

Limitations in Forecasting Using the Dow Jones Index

While useful, the index has forecasting limitations.

- Past performance does not guarantee future results

- Limited stock representation

- Sensitivity to individual stock price movements

It should be combined with broader indicators for predictive analysis.

Long-Term Relevance of the Dow Jones Index

Despite structural criticisms, the index continues to hold significance.

- Deep integration into financial systems

- Strong historical continuity

- Global recognition

Its role as a market sentiment indicator ensures ongoing relevance.

Dow Jones Index and Corporate Actions

Corporate actions directly influence how the Dow Jones Index behaves.

Common Corporate Actions

- Stock splits

- Mergers and acquisitions

- Dividend announcements

- Spin-offs

Because the index is price-weighted, stock splits require divisor adjustments to ensure continuity. Without these adjustments, the index value would change artificially even when market value remains unchanged.

Role of the Dow Jones Index in Market Psychology

Market psychology plays a major role in daily movements.

Psychological Importance

- Acts as a confidence indicator

- Influences investor sentiment

- Impacts short-term trading behavior

When the index crosses major psychological levels, it often triggers media attention and investor reactions, even if underlying fundamentals remain unchanged.

Dow Jones Index as a Benchmark for Mutual Funds

Many actively managed mutual funds and portfolio managers use the Dow Jones Index as a reference benchmark.

Why It Is Used

- Long historical data availability

- Recognizable market indicator

- Easy comparison for performance

Funds may not replicate the index exactly but compare returns to evaluate relative performance.

Dow Jones Index and Sector Rotation Strategy

Sector rotation strategies analyze how different industries perform during various economic cycles.

Economic Cycle Impact

- Expansion: Industrials and consumer stocks perform strongly

- Slowdown: Defensive sectors gain attention

- Recovery: Financial and manufacturing stocks rebound

Because the index includes leaders from multiple sectors, it provides insights into broader economic transitions.

Dow Jones Index in Risk Management

Risk managers monitor the index to assess overall market volatility.

Applications

- Portfolio hedging decisions

- Asset allocation adjustments

- Stress-testing financial models

Sudden changes in the index often signal rising systemic risk.

Dow Jones Index Futures and Derivatives

Financial derivatives are built around the index.

Common Instruments

- Futures contracts

- Options

- Exchange-traded products

These instruments allow traders to hedge risk or speculate on market direction without owning individual stocks.

Dow Jones Index and Inflation Sensitivity

Inflation impacts corporate profitability and investor expectations.

- Rising inflation can pressure interest rates

- Higher borrowing costs affect industrial companies

- Consumer spending patterns influence index movements

Tracking the index alongside inflation data provides better economic context.

Dow Jones Index in Global Market Correlation

Global markets are interconnected.

Observed Correlations

- Strong linkage with European markets

- Reaction to Asian market performance

- Sensitivity to global economic data

The index often reacts to overnight developments in international markets.

Dow Jones Index and Long-Term Historical Trends

Long-term trend analysis reveals economic resilience.

Historical Observations

- Recovery after economic downturns

- Growth during industrial expansion

- Stability during mature economic phases

This makes the index valuable for historical market studies.

Limitations in Modern Portfolio Construction

While influential, the index has structural constraints:

- Limited diversification

- Underrepresentation of emerging industries

- Price-weighted distortion

Modern portfolio strategies typically use it alongside broader indexes.

Dow Jones Index and Data Analytics

Financial analysts use historical index data to:

- Identify cyclical patterns

- Build forecasting models

- Analyze volatility trends

This data is frequently integrated into financial analytics platforms.

Dow Jones Index in Educational Finance Curriculum

The index is commonly taught in:

- Economics courses

- Finance degrees

- Investment certification programs

Its simplicity makes it ideal for introducing index-based analysis.

Regulatory Perspective on the Dow Jones Index

Although the index itself is not a tradable asset, financial products linked to it fall under regulatory oversight.

Regulations ensure:

- Transparency

- Fair trading practices

- Accurate pricing mechanisms

Future Outlook of the Dow Jones Index

The index continues to evolve:

- Periodic company rebalancing

- Adaptation to economic changes

- Continued relevance as a sentiment indicator

Despite criticisms, it remains deeply embedded in global financial culture.

Role of the Dow Jones Index in Financial Media

News outlets frequently reference the index in headlines to summarize market behavior quickly.

Its simplicity and recognition make it ideal for broad communication.

Tools and Platforms to Track the Dow Jones Index

Popular Platforms

- Financial news websites

- Trading platforms

- Market analytics dashboards

Summary and Key Takeaways

- The Dow Jones Index is one of the oldest market benchmarks

- It tracks thirty influential U.S. companies

- It uses a unique price-weighted calculation

- It reflects market sentiment rather than total market size

- It remains a trusted reference point globally

Final Thought

Understanding the Dow Jones Index helps investors, students, and professionals interpret financial markets with greater clarity. While no single index tells the full story, this benchmark continues to serve as a powerful indicator of economic confidence and market direction.

FAQ’s

What are the top 10 holdings in the Dow Jones?

The top 10 holdings in the Dow Jones Industrial Average typically include blue-chip companies like UnitedHealth Group, Goldman Sachs, Microsoft, Home Depot, Caterpillar, Salesforce, American Express, Amgen, McDonald’s, and Boeing, representing the largest weighted stocks in the index.

What is the 7% rule in stock trading?

The 7% rule suggests selling a stock if its price falls 7% below your purchase price to limit losses and protect capital from larger downturns.

What is the Dow theory for dummies?

Dow Theory is a simple market concept stating that stock market trends move in primary, secondary, and minor trends, and a trend is confirmed when major market indexes move in the same direction.

Is the Dow Jones a good indicator of the economy?

The Dow Jones is a useful but limited indicator, as it reflects the performance of major U.S. companies but does not represent the entire economy or all market sectors.

Which index is the best measure of the market?

Which index is the best measure of the market?

The S&P 500 is widely considered the best overall measure of the stock market because it represents 500 large U.S. companies across multiple sectors, offering broader market coverage than the Dow Jones.