Fraud has always been a cat-and-mouse game between criminals and organizations. With the exponential growth of digital transactions, fraudsters have become smarter, leveraging advanced tactics to bypass traditional detection systems. This is where Fraud Detection Machine Learning comes into play.

Machine learning models can analyze vast amounts of transactional data, spot anomalies, and detect fraud in real time—something rule-based systems alone cannot achieve.

This guide will take you deep into how machine learning is revolutionizing fraud detection, the algorithms behind it, real-world examples, and how organizations can build future-proof fraud detection systems.

What is Fraud Detection in Machine Learning?

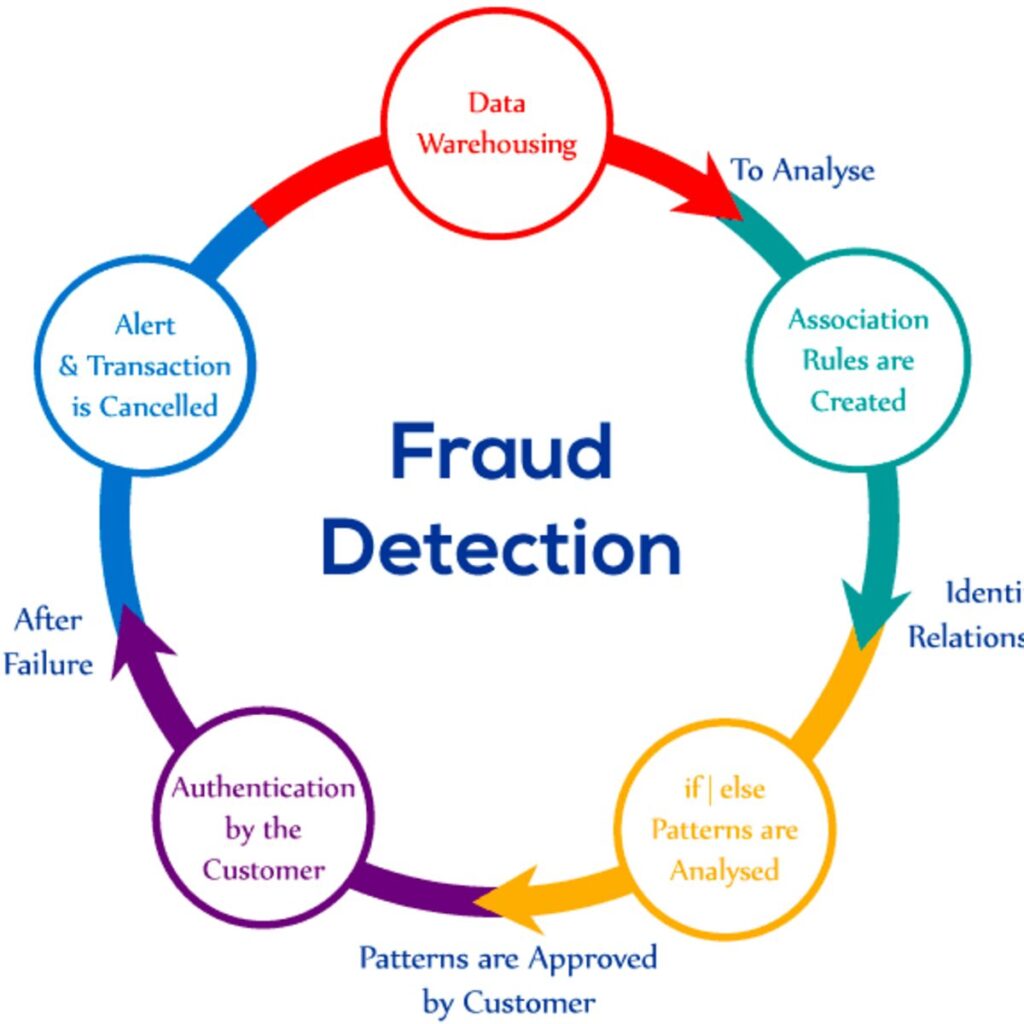

Fraud detection is the process of identifying illegal or suspicious activity across various industries such as banking, insurance, healthcare, and e-commerce.

Machine Learning enhances this process by:

- Learning from historical fraud data.

- Identifying hidden patterns in transactions.

- Reducing false positives.

- Adapting to new fraud strategies.

Instead of relying only on predefined rules (e.g., blocking transactions over $10,000), ML models can adaptively learn from fraudsters’ evolving behavior.

Why Fraud Detection is Critical in Today’s Digital Economy

- According to Statista (2024), global losses from online payment fraud are expected to reach $40.6 billion by 2027.

- The Association of Certified Fraud Examiners (ACFE) estimates that organizations lose 5% of annual revenue to fraud.

- With the growth of digital wallets, contactless payments, and cryptocurrency, fraud risks have multiplied.

Thus, fraud detection powered by machine learning isn’t just a security tool—it’s a business necessity.

Types of Fraud in Different Industries

Fraud manifests differently across industries.

1 Banking & Financial Services

- Credit card fraud

- Identity theft

- Money laundering

- Loan fraud

2 Insurance

- False claims (car accidents, health treatments)

- Policy manipulation

- Premium evasion

3 E-commerce & Retail

- Account takeover

- Fake reviews

- Return fraud

- Promo code abuse

4 Telecom & Cybersecurity

- SIM card fraud

- Fake subscription signups

- Phishing & malware-driven fraud

Example: In 2023, a U.S. bank used ML-powered fraud detection to prevent $200 million worth of fraudulent credit card transactions.

Traditional Fraud Detection Techniques vs. Machine Learning Approaches

Traditional Techniques:

- Rule-based (e.g., blocking transactions above a certain threshold).

- Manual reviews.

- Statistical anomaly detection.

Machine Learning Approaches:

- Automated pattern recognition.

- Adaptive learning to catch new fraud strategies.

- Scalability for millions of transactions per second.

How Machine Learning is Transforming Fraud Detection

Key transformations include:

- Real-time monitoring of transactions.

- Anomaly detection in complex datasets.

- Automated feature selection for accuracy.

- Continuous model improvement with feedback loops.

For example, PayPal uses deep learning to analyze hundreds of variables per transaction, reducing fraud rates significantly.

Key Machine Learning Algorithms for Fraud Detection

Fraud detection relies on multiple algorithms:

- Logistic Regression → Simple and interpretable.

- Decision Trees & Random Forests → Great for classification tasks.

- Support Vector Machines (SVM) → Effective in high-dimensional data.

- Neural Networks & Deep Learning → Best for large, unstructured datasets.

- Gradient Boosting (XGBoost, LightGBM, CatBoost) → High accuracy and efficiency.

- Unsupervised Learning → Detects anomalies when labeled fraud data is limited

Real-Time Example: Mastercard’s Decision Intelligence platform uses gradient boosting and neural networks to prevent fraud before authorization is completed.

Data Preprocessing for Fraud Detection Models

- Handling Class Imbalance → Since fraud is rare, techniques like SMOTE (Synthetic Minority Oversampling Technique) are used.

- Feature Engineering → Creating features like transaction frequency, velocity, and device ID.

- Dimensionality Reduction → PCA (Principal Component Analysis) helps simplify large datasets.

Example preprocessing pipeline:

- Clean transaction logs.

- Remove duplicates.

- Normalize amounts.

- Extract time-series features.

Real-Time Fraud Detection with Machine Learning

- Streaming data processing with Apache Kafka & Spark Streaming.

- Real-time scoring using pre-trained ML models.

- Adaptive learning for evolving fraud techniques.

Example: VisaNet processes 65,000+ transactions per second using ML for instant fraud screening.

Challenges in Fraud Detection Machine Learning

- Imbalanced datasets (fraud is <1% of transactions).

- Evolving fraud tactics (fraudsters change patterns).

- False positives (legitimate transactions flagged as fraud).

- Data privacy regulations (GDPR, CCPA).

Case Studies & Real-Time Examples

- PayPal → Deep learning models reduced false positives by 60%.

- Mastercard → AI-driven fraud detection prevented billions in losses.

- Healthcare Insurance → ML detected fraudulent claims saving millions annually.

- Telecom → Fraud detection prevented large-scale SIM-swap scams.

Tools & Frameworks for Fraud Detection Machine Learning

- Scikit-learn → Baseline ML models.

- TensorFlow & PyTorch → Deep learning.

- Apache Spark MLlib → Big data fraud detection.

- H2O.ai → Automated fraud model building.

- Azure Fraud Detection Studio / AWS Fraud Detector → Cloud-based solutions.

Graph-Based Machine Learning for Fraud Rings

Traditional models often focus on individual transactions, but fraud rarely happens in isolation. Fraudsters often operate in networks or rings.

- Graph Neural Networks (GNNs) can detect hidden connections between entities (accounts, IP addresses, devices) to uncover fraud rings.

Example: Detecting multiple fake accounts linked through shared contact information or device fingerprints.

Behavioral Biometrics in Fraud Detection

- Beyond transaction data, ML models now analyze user behavior like keystroke dynamics, mouse movements, or mobile gestures.

Example: If a fraudster steals credentials but their typing speed or mobile swipe pattern differs from the genuine user, the system flags it. - Companies like BioCatch are using behavioral biometrics in fraud prevention.

Adversarial Machine Learning in Fraud Scenarios

- Fraudsters often probe detection systems by running small fraudulent transactions to test detection thresholds.

- Adversarial ML techniques simulate these attacks during training to make fraud models more resilient.

Example: Training models to recognize micro-transaction fraud testing patterns.

Multi-Modal Data Fusion

Fraud detection systems increasingly integrate data from multiple sources:

- Transactional data (amount, location, frequency).

- Device data (browser fingerprint, IP address, OS).

- Social data (relationships between entities).

- Geospatial data (location mismatch between device and transaction).

Machine learning models can combine structured + unstructured data for stronger fraud detection.

Federated Learning for Privacy-Preserving Fraud Detection

- In highly regulated industries like banking, data sharing is restricted due to privacy laws (GDPR, HIPAA).

- Federated learning allows banks to train fraud detection models collaboratively without sharing raw data.

- This enhances fraud detection globally while maintaining data confidentiality.

Real-Time Adaptive Learning Systems

- Instead of retraining models monthly or quarterly, organizations are shifting to adaptive learning models that update continuously based on incoming fraud signals.

Example: An auto-retraining fraud detection pipeline that ingests new fraud cases daily and recalibrates model weights automatically.

Explainable AI (XAI) in Fraud Detection

- Regulators demand that organizations explain why a transaction was flagged as fraud.

- Explainable AI helps make ML models transparent by showing which features (e.g., sudden location change, unusual amount) contributed most to the fraud alert.

- This builds trust with customers and ensures regulatory compliance.

Hybrid Models (Rule-Based + Machine Learning)

- Pure ML systems can sometimes produce false positives, frustrating customers.

- Hybrid systems combine rules + ML models:

- Rules for predictable fraud patterns (e.g., blocked stolen cards).

- ML for detecting new, unknown fraud patterns.

- Rules for predictable fraud patterns (e.g., blocked stolen cards).

- This balances accuracy and customer satisfaction.

Cost-Sensitive Learning in Fraud Detection

- Not all fraud has the same cost. A fraudulent $10 charge is less critical than a $100,000 wire transfer.

- Advanced ML models use cost-sensitive algorithms that weigh fraud by financial impact, prioritizing high-value fraud prevention.

Fraud Detection in Cryptocurrencies & Blockchain

- With the rise of crypto transactions, new fraud risks appear:

- Wash trading

- Pump-and-dump schemes

- Fake token launches

- Wash trading

- Machine learning is now used to detect abnormal blockchain wallet activity, unusual DeFi trades, and crypto fraud rings.

Synthetic Data for Fraud Detection Model Training

- Since fraud cases are rare, datasets are often imbalanced.

- Companies now generate synthetic fraud data using Generative Adversarial Networks (GANs) to train models effectively.

Example: Creating artificial fraudulent transactions to balance datasets and train more robust fraud classifiers.

Reinforcement Learning for Fraud Prevention

- Reinforcement learning (RL) agents are being used to dynamically adapt fraud thresholds.

- For example, an RL agent can balance between blocking fraud and minimizing false positives by learning from customer reactions.

Industry Collaboration & Shared Databases

- Fraudsters often reuse strategies across organizations.

- Consortium-based ML systems allow multiple banks/insurers to share anonymized fraud data to detect cross-institution fraud more effectively.

Example: The Early Warning Services consortium in the U.S. helps banks detect fraud across institutions.

Future Direction – Quantum AI in Fraud Detection

- Quantum computing could drastically improve fraud detection by analyzing massive, high-dimensional datasets in near real-time.

- Future fraud detection systems may combine quantum machine learning (QML) with classical ML for enhanced performance.

Future Trends in AI-Powered Fraud Prevention

- Graph Neural Networks (GNNs) for fraud ring detection.

- Federated learning for privacy-preserving fraud detection.

- Explainable AI (XAI) for regulatory compliance.

- Quantum computing for faster fraud pattern detection.

Advantages of Using Machine Learning for Fraud Detection

- Real-time detection.

- Reduction in false positives.

- Scalable for millions of transactions.

- Continuous learning.

- Cost savings and revenue protection.

Ethical & Privacy Concerns in Fraud Detection Systems

- Over-surveillance risks.

- Data sharing and privacy violations.

- Bias in training datasets.

- Need for transparent AI models.

Best Practices for Building a Fraud Detection Model

- Start with balanced datasets.

- Use ensemble models for better accuracy.

- Continuously retrain models.

- Monitor drift in fraud patterns.

- Collaborate across industries for better datasets.

Conclusion

Fraud detection is no longer just about catching fraud after it happens—it’s about preventing it before it occurs. Machine learning has become the backbone of modern fraud prevention, powering industries from banking to healthcare to e-commerce.Organizations that invest in fraud detection machine learning not only save billions in losses but also protect customer trust. As fraudsters evolve, machine learning will remain the ultimate power tool for combating financial crimes.

FAQ’s

How is machine learning used in fraud detection?

Machine learning is used in fraud detection by analyzing transaction patterns, identifying anomalies, and detecting suspicious activities in real time, helping organizations prevent financial crimes more effectively.

Which type of machine learning model is often used to detect fraud in the financial industry?

In the financial industry, supervised learning models like logistic regression, decision trees, and random forests are commonly used for fraud detection, while unsupervised models like clustering and autoencoders help identify hidden fraud patterns without labeled data.

Which algorithm is used for fraud detection?

Common algorithms used for fraud detection include Logistic Regression, Decision Trees, Random Forest, Gradient Boosting, Neural Networks, and K-Means Clustering, chosen based on whether the approach is supervised (labeled fraud data) or unsupervised (detecting anomalies).

What is the best AI model for fraud detection?

The best AI models for fraud detection are often Random Forest and XGBoost, as they handle imbalanced data well and provide high accuracy in detecting fraudulent patterns.

How to detect financial fraud?

Financial fraud can be detected using data monitoring, anomaly detection, and machine learning models that analyze transaction patterns, flag unusual activities, and identify suspicious behavior in real time.